Rewarding

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

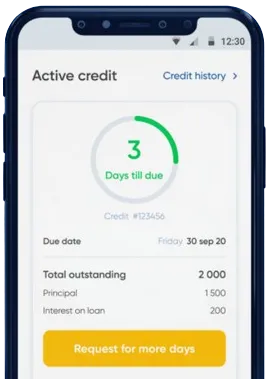

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Place your request via our app, just by filling out the form.

Anticipate our decision, made swiftly in 15 minutes.

Have the money transferred to you, usually within one minute.

Place your request via our app, just by filling out the form.

Download loan app

Personal loan in Nigeria offer numerous benefits to individuals looking for financial assistance. Whether you need funds for emergencies, education, home improvements, or debt consolidation, personal loan can be a reliable solution.

One of the key benefits of personal loan is their flexibility. Borrowers have the freedom to use the funds for various purposes without restrictions, unlike other types of loans that may have specific use requirements.

Overall, the flexibility of personal loan makes them a versatile financial product that can adapt to your individual needs.

Another advantage of personal loan in Nigeria is the quick approval process. Unlike traditional bank loans that can take weeks to process, personal loan are often approved within a few days, providing fast access to much-needed funds.

Additionally, many lenders offer online applications for personal loan, simplifying the process and making it more convenient for borrowers to apply from the comfort of their homes.

Personal loan in Nigeria often come with competitive interest rates, making them an affordable borrowing option for individuals seeking financial assistance. By comparing offers from different lenders, borrowers can find the best rates that suit their budget and repayment capacity.

Taking out a personal loan and making timely repayments can help improve your credit score over time. By demonstrating responsible borrowing behavior and maintaining a positive repayment history, you can strengthen your credit profile and increase your chances of qualifying for future loans or credit products.

Consistent loan repayments show lenders that you are a reliable borrower, which can result in better loan terms and lower interest rates in the future.

In conclusion, personal loan in Nigeria offer a range of benefits that can help individuals achieve their financial goals and overcome temporary financial challenges. From flexibility and quick approval processes to competitive interest rates and credit score improvement, personal loan provide a practical and efficient solution for those in need of financial assistance.

A personal loan is a type of loan that is issued to an individual for personal use, such as paying off bills, financing a wedding, or making home improvements.

Typically, you will need to provide proof of identity (such as a driver's license or passport), proof of income (such as pay stubs or bank statements), and proof of residence (such as utility bills or rent receipts).

The interest rates on personal loans in Nigeria can vary depending on the lender and your creditworthiness. On average, interest rates can range from 5% to 30%.

The time it takes to get a personal loan approved in Nigeria can vary depending on the lender, but it usually takes anywhere from a few days to a couple of weeks.

Yes, some lenders in Nigeria offer personal loans to individuals with bad credit. However, your interest rate may be higher, and you may be required to provide additional documentation or collateral.

Repayment terms for personal loans in Nigeria can vary, but they typically range from 6 months to 5 years. Some lenders may offer flexible repayment options, such as making bi-weekly or monthly payments.